MONEY-MANAGEMENT FORMULA THAT WORKS FOR US

- Andre Dirckze

- Aug 4, 2020

- 5 min read

Updated: Sep 16, 2020

COVID-19 Has certainly accelerated the decline in our a cash culture.

With the advancements in tech you don’t need a to carry a card all you need is your phone to make your purchases. While these advancements have made our lives easier and safer, it’s certainly becoming increasingly difficult track where all our money is being spent in our tap and go society.

Often families blow a large hole a hole in their budget, before they realise.

If you’re working toward a specific goal, like saving for your first investment property or for your children's education the key is to stick to a simple and easy to manage money management system to stay on top of your spending.

Losing track of the finances

Even the best-intentioned families can let their spending get on top of them.

A lot of families have multiple credit cards and too many back accounts, spread across too many financial institutions. A common mistake that many people fall into is that they credit all their money into their everyday spending account, hoping there will be savings left over at the end of each month. Many families spend without actually keeping track of a budget.

If you relate to anything you’ve just read then the first step is to understand where you are spending you money.

The key is to get organised and put in a little effort track where your money is going. Once you know - putting in place a workable money management system is easy.

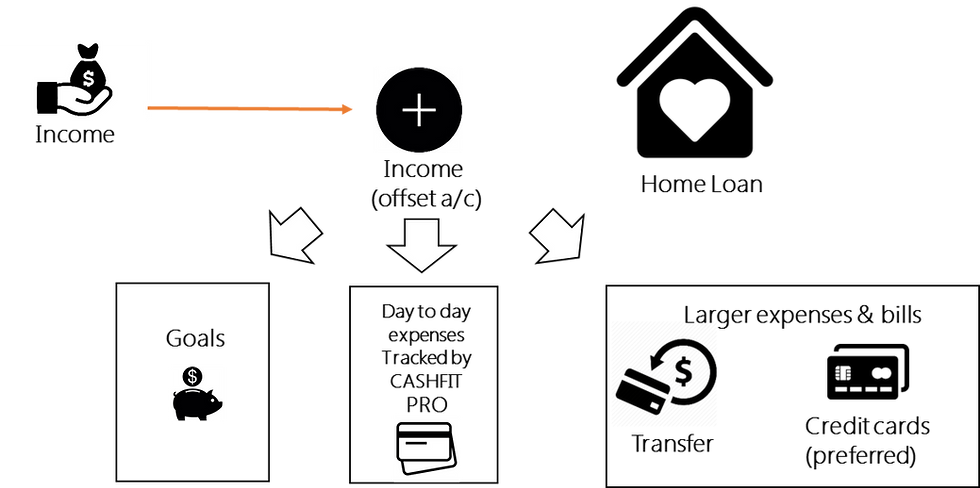

LETS TAKE A LOOK AT OUR MONEY MANAGEMENT SYSTEM

Managing your cashflow is simple - Great news right! – You just need to courage to stick to the plan. Here’s the four-step money management system that’s worked for me over the past few years…

3 Accounts at best.

Three account should be more than enough to manage this system – each account has a purpose. *With the exception of your emergency account.

1. ‘Income Account & Large Bills account’.

This account is where all your salary credits and other income are collected, such as rent from an investment property or maybe some side hustle money. If you have a home loan, your offset account would be perfect for this (if you don’t have an offset account call us to review your strategy). Online High interest saving accounts are a great alternative, best rate in the market can be found at places like finder.com.au. Ensure all your major bills, such as loan repayments, utilises, car payments come from of this account.

2. ‘Day to day spending’ account, which should have a Debit Card attached You can use this for everyday spending on smaller items. This should be used to withdraw ‘cash’ and pay for smaller items.

3. ‘Goal Saver’ account and should also be a high-interest one. You can use this specifically for savings goals like - Children’s education savings or a family holiday.

Know your budget

This is where you can get to work and starting finding out exactly where you money goes – on a month to month basis.

There are number of great apps to assist with this exercise such as Money Brilliant, Pocket book or Spendee there are even more budget tools you can find online. You are welcome to reach out and we’ll send you a copy of out cash-flow management tool of our allocation tool 50/30/20.

Now that you’re empowered with this information, calculate an allowance taking into consideration bills, both large & small versus your day-to-day spending. Be careful and ensure you are not spending more than what comes in.

Automate your cash flow.

As we said above, all income will come into your ‘income’ account and you’ll have your ‘allowance’, to spend on the things you love, whatever that amount is.

Please note, we have deliberately overlooked credit cards as the intention is to keep things simple and getting you on top of your spending.

It’s best to automate your payments by direct debit,

1. Set up for your allowance to credit your ‘day to day spending’ account. Weekly, fortnightly, monthly – in line with your pay cycle. This will change your spending psyche and help you adjust to your new allocated discretionary spending account.

2. Next set up a direct debit out of your ‘income’ account to support your ‘savings goals’ account. If you’re saving for a holiday, for example, it might be a case of sticking $250 into this account each week.

3. Lastly, set up an account that takes care of your major bills and where possible ensure direct debit are set to take major bills from your offset account or high interest saver if you don’t have an off set.

The System 50/30/20

Essential expenses – 50 percent: As the name suggests, these relate to everything you can’t live without. Namely shelter and utilities, groceries, healthcare, travelling to work and getting around, education costs, etc.

Priority spending – 30 percent: This should be for household and personal expenses such as dining out, clothing, personal care items, gym memberships, etc. Ultimately, this is the category that you should focus on shifting your spending behaviour.

Potential/Future– 20 percent: This should be set aside for investing in your potential, creating your emergency funds, savings, investing in yourself.

And below will give you a bit of a snapshot as to how it all works…

STAYING ON TOP OF IT ALL

Having a system’s is great, however ensuring it works over the long term’s another. Once you’ve implemented the system, the best thing to do is make routine in your life. These three things will help you stay on top.

1. Track your spending: if you have your spending data in hand, (via one of the apps mentioned above) it allows you to check and monitor and create better spending habits. Once you have your head around the system, keep account of your expenditure ensuring you stick to the categories and keep allocating where necessary.

2. Adjust your discretion spend: You may need to adjust your discretion spend up or down over the first few months until you get a clear picture. In the long run, your discretionary spend will be the key factor in ensuring your money is going toward greater life goals and objectives.

3. Try to stick to the 50/30/20 rule: It can be difficult, I know, but this is the ultimate goal, spending wise, for each category. If any of them start to go above the average, you may need to start employing some money-saving measures in the category that’s consistently going over.

This is easier said than done, it can take a while to become normal way managing your finances, but once you do you never look back.

For us this system has been perfect in helping us find the balance between living our best life as family and making our income go further and importantly ensuring we are prepared for future.

Please feel free to call or book an appointment we are always happy to help.

Comments